FAQs on Free Healthcare

(100% government-subsidized free COBRA)

Q: What is free COBRA healthcare coverage?

Congress passed the latest stimulus package called the American Rescue Plan Act in March 2021. Along with the stimulus checks we all received, it also provides 100% FREE healthcare coverage from April 1–September 30, 2021 for people eligible because they lost coverage due to involuntarily reduced hours or layoff—including covered dependents.

COBRA is not a health plan but a federal law that requires your employer to extend your workplace health insurance when you lose coverage due to job loss, reduced hours and other circumstances specified by law. We won the right for the government to pay for it for up to 6 months.

Q: How do I know if I’m eligible for free COBRA?

You’re eligible now if you lost coverage due to involuntary job loss (other than for gross misconduct) or reduced work hours between November 1, 2019 and March 31, 2021.

You can become eligible for free COBRA if you involuntarily lose your job or have your hours reduced between April 1 and September 30, 2021.

Q: Can I qualify for free COBRA if I’m still working?

Yes! If you have not been terminated or laid off, but have lost coverage due to reduced hours, you are eligible.

Q: What if I’m eligible for Medicare—can I sign up for free COBRA?

No. People who are eligible for Medicare—government healthcare for people over age 65—are NOT eligible for free COBRA. If you are eligible for Medicare but not enrolled, you still are NOT eligible for the free COBRA paid for by the federal government.

Q: What if I’m eligible for Medicaid—can I sign up for free COBRA?

Yes! People who are eligible for their state’s Medicaid program—government healthcare for low-income and disabled people—you can still be eligible for free COBRA. You should decide if it is worth switching your healthcare coverage.

Q: Who is NOT eligible for free COBRA healthcare coverage?

You are NOT eligible if you:

- Terminated your job voluntarily or were fired for gross misconduct.

- Are eligible for other group insurance—from another job or spouse—or for Medicare coverage (if you’re eligible for Medicare coverage through work hours or employer contributions); or

- Are a dependent and lost your coverage as a result of divorce, death, or because you turned age 26

Q: What happens if I enroll and I’m not eligible?

If you are not eligible for free COBRA coverage, and mistakenly enroll, you must inform your health plan as soon as possible so you can be removed from the program. If you don’t, you may have to pay back the government for the cost of your healthcare coverage.

Q: What if I become eligible for other group health insurance or Medicare after I enroll?

If you become eligible for other group health insurance or Medicare after you enroll, you must inform your health plan immediately so they can remove you from the program. If you don’t, you may have to pay back the government for the cost of your COBRA premium for the months that you were eligible for the other group health insurance or Medicare.

Q: What do I have to do to get free COBRA coverage?

You must fill out forms saying you’re eligible and want to enroll.

If you are a member of UNITE HERE Health, go here to check eligibility and sign up: www.uhh.org/rescue.

For everyone else, your health insurance plan has to send you COBRA enrollment materials by May 31, 2021. You should call HR at your old job or your old health plan’s customer service number to confirm or update your contact information and ask them when you can expect enrollment forms. Also, check your mail for your enrollment packet.

Q: What benefits will be covered under free COBRA?

In most cases, you will be offered the same coverage you had while working. Your health plan may offer different coverage at the same or lower cost, but it has to be the same quality as your old coverage.

Coverage will be offered to the same dependents you previously covered, but you don’t have to cover all your previously-covered dependents. You will not be able to add new dependents not previously covered.

Q: How long does free COBRA coverage last?

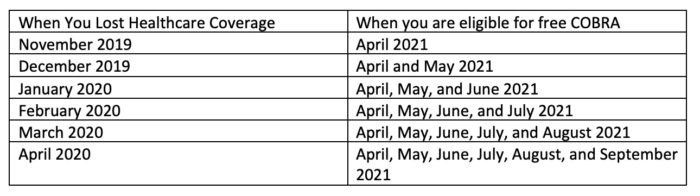

Workers who lost coverage between April 1, 2020 and March 31, 2021 are eligible for 6 months of free COBRA coverage (unless you become eligible for healthcare coverage through work, other group insurance, or Medicare). Most workers who lost coverage between November 2, 2019 and March 31, 2020 are eligible for 1–5 months of free COBRA healthcare, depending on when you lost coverage. Workers who lose coverage between April 1, 2021 and September 30, 2021 will also be eligible for free COBRA coverage.

Q: What if start working enough hours to get healthcare coverage, but then lose hours and coverage again?

If you lose coverage again before October 1, 2021 and you otherwise qualify, you can re-enroll in the free COBRA coverage.

Q: How long do I have to decide if I want free COBRA coverage?

If you are eligible for free COBRA coverage, you will have 60 days from when you get your enrollment packet to complete and return the forms to your insurance company stating that you want free COBRA. This is called “electing” coverage.

Q: Am I eligible for COBRA if my company closed or went bankrupt?

If your company closed or filed for bankruptcy, it may no longer have a healthcare plan and you may not be offered COBRA coverage. If, however, there is another plan offered by the company, you may be covered under that plan. Where a company has filed for bankruptcy, union members who are covered by a collective bargaining agreement that provides for a medical plan also may be entitled to continued coverage. Please contact your Union representative if your company has closed or filed for bankruptcy.

Q: If I enrolled in an ACA insurance plan (or one of my dependents did), can I now drop that insurance and enroll in free COBRA?

Yes! You can drop your ACA insurance plan and should notify the marketplace plan that you are leaving as soon as possible. If you elect to enroll in free COBRA, you will no longer be eligible for a tax credit, or advance payments of the tax credit, for the ACA insurance plan. You must contact the marketplace plan to let them know that you’ve enrolled in free COBRA or you may have to repay some or all of the advance payments of the tax credit when you were enrolled in both free COBRA and marketplace coverage.